Survivorship Bias

- Elijah Tan

- Feb 5, 2022

- 4 min read

Now, what does surviving have to do with investments? Well, let me share with you some stories first before getting into the midst of things.

During World War 2, planes that made it back were analysed for where bullet holes were observed. Suggestions were that armour could be concentrated onto parts that were severely hit and thus reducing the need for resources. Which part as marked by the red dots in the above picture would you place your armour on?

Counterintuitively, where armour should instead be on would be the parts that do not contain bullet holes. The very fact that planes could return safely despite behind filled with bullet holes is a testament that those parts were not fatal for the planes. This is an example of the Survivorship Bias.

You may also have heard from friends around you that “old or classical music is much better than music today”. Well, that’s pretty much true – only for those that made it to the ears of people today. These classics have been tried and tested through time and have thus made it through the generations which indicates quality. They are likely the best of their times and have tugged the heartstrings of many for them to have survived till this age.

Similarly, for ancient architecture – they must have the best designs and foundation for them to be maintained till this date. It is not the case that all architects of the past have better interior designing skills than modern ones but rather, the amazing ones are retained and not torn down by our modern society for preservation purposes.

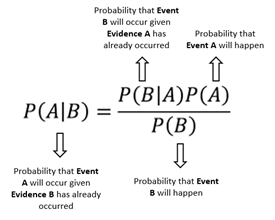

So more about statistics. I believe you have heard about this very famous probability theory called the Bayes’ Theorem. It’s the most hated and most confusing theory in Introduction to Statistics but it reminds us how we need to view events with a more stringent thought. Mathematically, it is presented as the monstrosity you see below:

It pays to know that most events we observe have already a given Evidence P(B). We will never have a full scope of the entire world. An external tuition teacher will start thinking that all teachers in public schools are terrible because it is only the students that have terrible teachers require tuition. A teenager with a gold spoon will never know the depths of poverty and have a highly inflated view of the median salary. And, for investors, we may judge our next 10 years of returns based off the average of (surviving) stock returns in the past 10 years.

Savant Capital, back in 2006, did a study on Morningstar’s trailing total return from 1995-2004 which excludes any fund that have been fully liquidated within the past 10 years. Morningstar’s trailing total return shown was a good 10.8% per year for US equities but if we were to include funds that have been liquidated, returns are at 8.9% per year. That’s nearly a 2% difference in absolute returns.

It could also be even more dangerous if fund managers choose to only report funds that have performed well.

Relating back to our own analysis of individual stocks, we may tend to use certain comparative ratios such as Price-to-Earnings. One danger that may surface would be that a historical trailing P/E may only include surviving companies and thus overstate or understate the true median. If we have an overstated P/E ratio, our “over-valued” stock may be even more overvalued now.

Another example that may be closer to us would be the very well-known Wall Street Bets. Some claim that investing in certain stocks or utilising a certain trading strategy can promise you your retirement instantly. Yes, they may have showed you “success” with 10 times returns or more, but they are the lucky ones who have survived an extremely risky strategy.

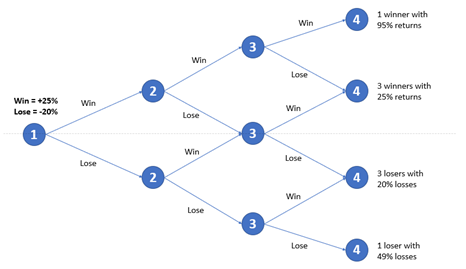

Just imagine that a trading competition requires you to make only 3 trades with a 50% chance to win or lose on each trade. Each win nets you a +25% gain while a loss nets you a -20% loss. Now, with this simple binomial tree, we see that there will be exactly 4 winners and 4 losers. There is also a clear winner with 95% returns in just 3 trades. In just 8 people, and assuming everyone employs a different strategy, we can guarantee a super-winner. Translating this visualisation to the real-world with many trading strategies, outcomes, and probabilities, there are also as many people trading out there. Every year, there will be people who will beat the S&P500 by a huge margin, and this same set of investors may continue their streak for the next few years even. However, be mindful of the need to validate these strategies or stories with your own logic first before diving into employing them.

Have a monkey throw darts at a stock selection board filled with tech stocks and you may also make the same returns as a fund that goes by the name ARK. Survivorship bias is out there and that fits the narrative of Noah & The 40-Day Great Flood. Just be careful not to end up in a situation that you may need a renaming to the Titanic.

If you're interested to chat on this topic or to exchange ideas, please feel free to drop me a message on Telegram @elijah2212 or through email elijah.thj@gmail.com!

Comments